Most innovative car manufacturers

of the 21st-century revealed

It’s hard to keep up with all the gadgets, functionalities and improvements that are constantly added to new cars. What was a groundbreaking invention seven years ago is likely now a standard feature. But how many new ideas are car manufacturers working on? And what car companies are really paving the way when it comes to filing patents and coming up with new ways of doing things?

Here at Lease Fetcher (number one spot for comparing business lease and personal lease deals), we set about extracting patent data via Espacenet by EPO (the European Patent Office) from the past 19 years (2001-2020), in a bid to answer some of these questions today.

Let’s get to it.

The most innovative car manufacturer

Innovations aren’t only about bells and whistles, it’s also incremental “boring” adjustments to existing technology that improves the product or the manufacturing process in some way.

By extracting patent applications from the previous twenty years, we’ve been able to identify the car manufacturers that are investing most in new technologies.

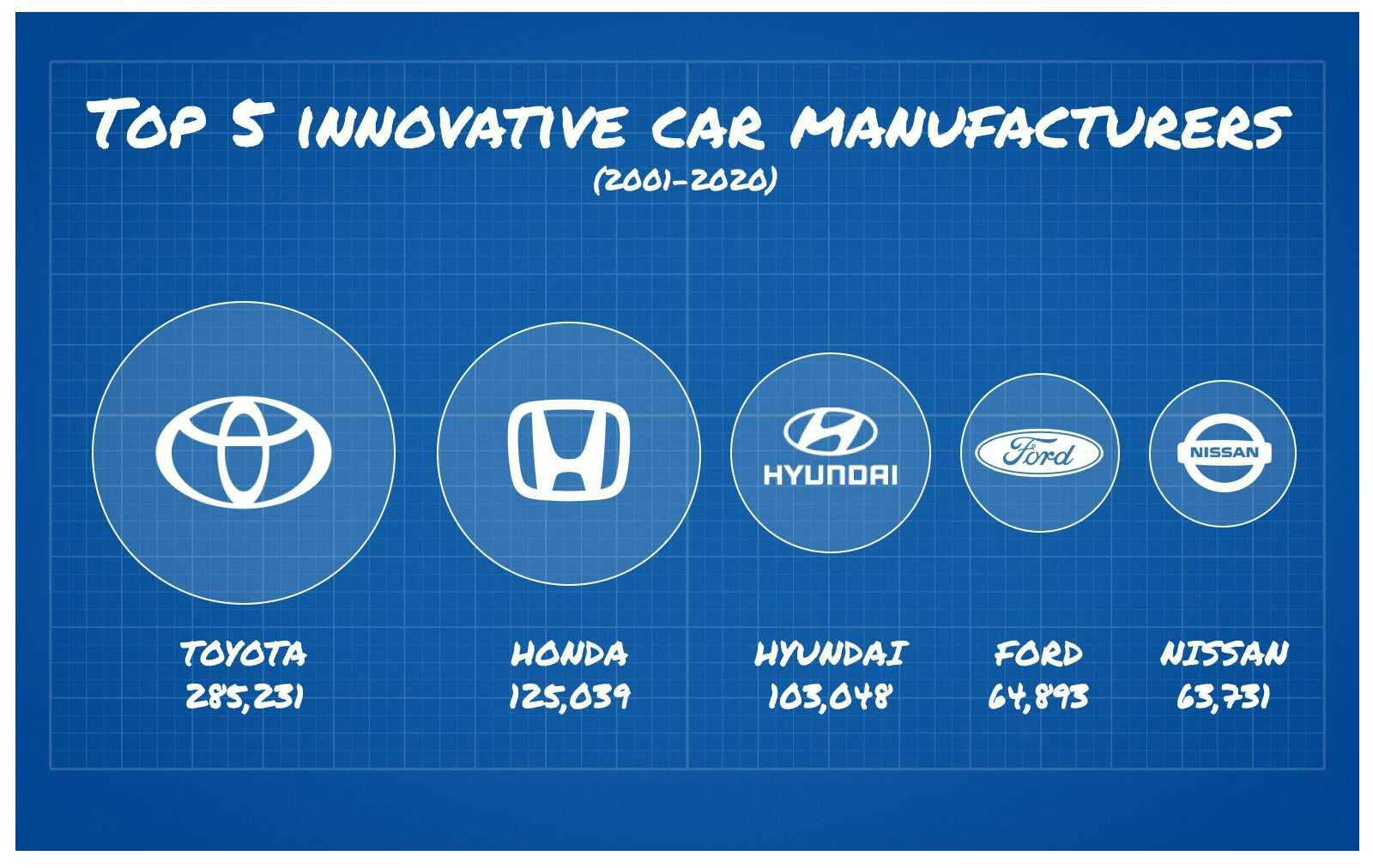

The most innovative is Toyota with a total of 285,231 patent applications. Spread across 20 years, that’s an average of 273 patent applications per week. It’s safe to say they’ve been busy at Toyota HQ.

On a close second is Honda with 125,039 patent applications or 119 per week on average.

Third place goes to Hyundai with 103,434 patent applications or 99 per week on average.

Fourth place goes to Ford with 64,893 (avg. 62 per week) and fifth Nissan with 63,731 (avg. 61 per week).

See the table below for the top 25 most innovative car manufacturers.

Note that the data extracted spans 20 years, leaving innovation hotbeds, like Tesla, and early-stage startups like Fisker and Rivian at a disadvantage. We’ll come back to some of these companies at a later stage.

If you know a bit of car manufacturing heritage and where the different companies come from, you’ll likely have noticed a bit of a trend in the top 5...

The most innovative country & continent

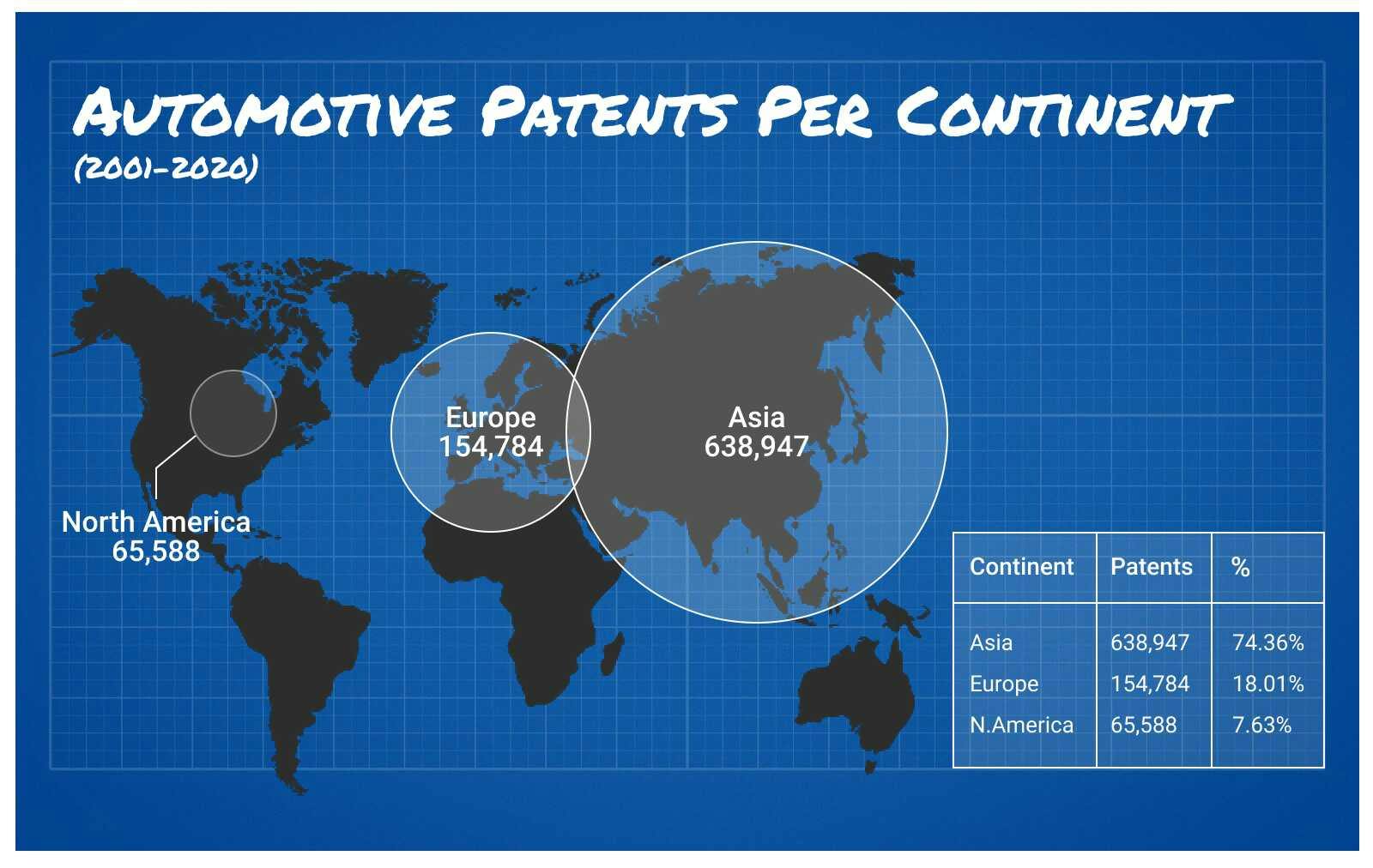

The top three on the list of the Most Innovative Car Manufacturers are all from East Asia, followed by American staple Ford, and back to East Asia for 5th place with Japanese Nissan.

East Asia is crushing the top 5 when it comes to patent applications.

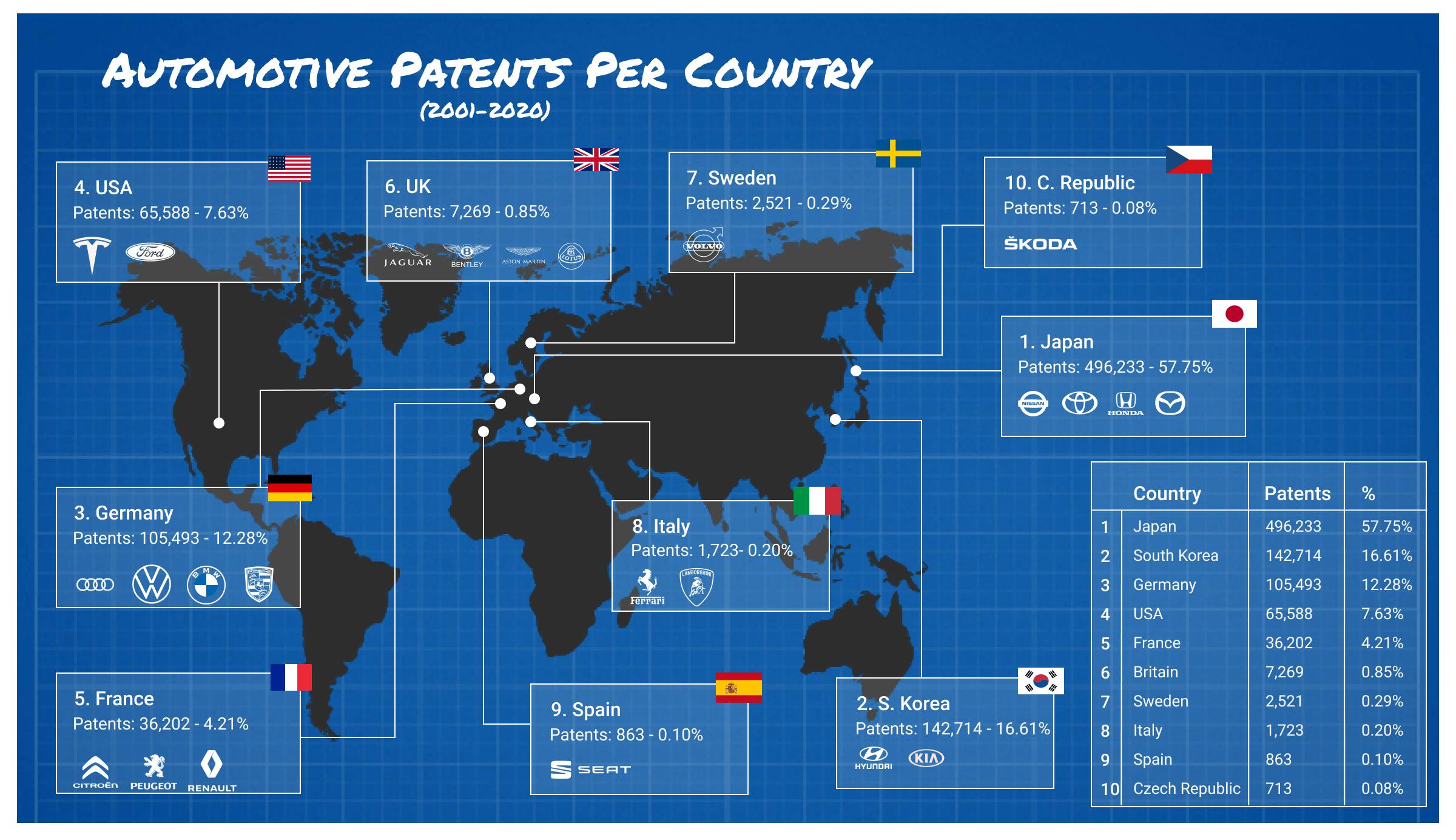

Split our top 20 car manufacturers up by country and Japan takes an impressive lead with 57.75% of all patent applications.

South Korea takes a convincing second place with 16.61%, and Germany in third with 12.28%.

Considering the size of Japan and South Korea, it’s truly astonishing the pool of talent they’ve built and the speed and priority of which they are pushing innovation.

Countries such as the United States, Spain and the United Kingdom can be found further down the list of most innovative countries for car manufacturing.

The top three on the list of the Most Innovative Car Manufacturers are all from East Asia, followed by American staple Ford, and back to East Asia for 5th place with Japanese Nissan.

East Asia is crushing the top 5 when it comes to patent applications.

Split our top 20 car manufacturers up by country and Japan takes an impressive lead with 57.75% of all patent applications.

South Korea takes a convincing second place with 16.61%, and Germany in third with 12.28%.

Considering the size of Japan and South Korea, it’s truly astonishing the pool of talent they’ve built and the speed and priority of which they are pushing innovation.

Countries such as the United States, Spain and the United Kingdom can be found further down the list of most innovative countries for car manufacturing.

Leading manufacturers investing in electric technology

By general electricity patents (including but not limited to EV technology)...

There are two ways to look at patents in the CPC classification of electricity (this category includes all electricity patents but is not limited to electric vehicle patents).

You can look at either the total volume of electric patent applications or the electricity percentage of total patents. The first gives a good representation of the sheer breadth of involvement in the category of electricity, the second a clear indication of electric priorities within the specific company.

By total volume of electricity patents, Toyota takes a big lead with 32,702 patents. In second place is Hyundai with 10,254, and in third place, Honda with 9,859 electricity patents.

By electricity percentage of all patent applications, Tesla holds a strong first place with 42.01% of all their patents electric. Nissan comes in second with 13.62% and Audi in third with 13.50% of all patents electric.

By electric vehicle & electric vehicle components patents...

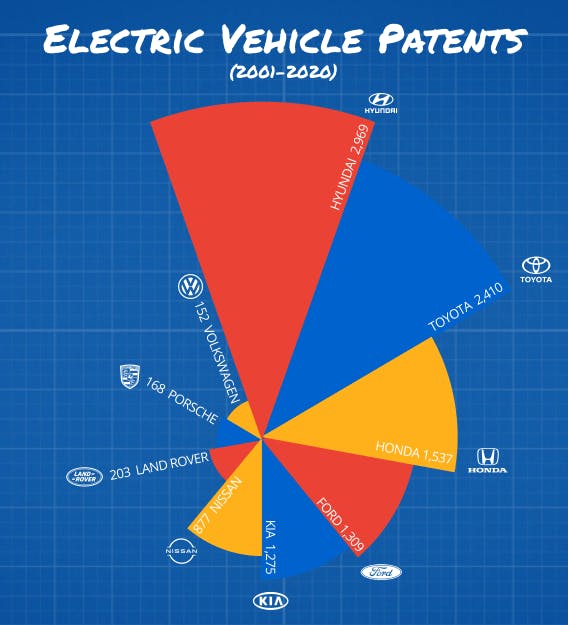

Looking more specifically at patents concerning electric vehicles and components, it’s Hyundai that takes the lead with 2,969 electric vehicle patents over Toyota (2nd) with 2,410. In third place with 1,537 patents is Honda.

With a good number of electric vehicles already on the market, it’s no surprise that these three East Asian manufacturing and innovation powerhouses take the three top spots for most electric vehicle patents.

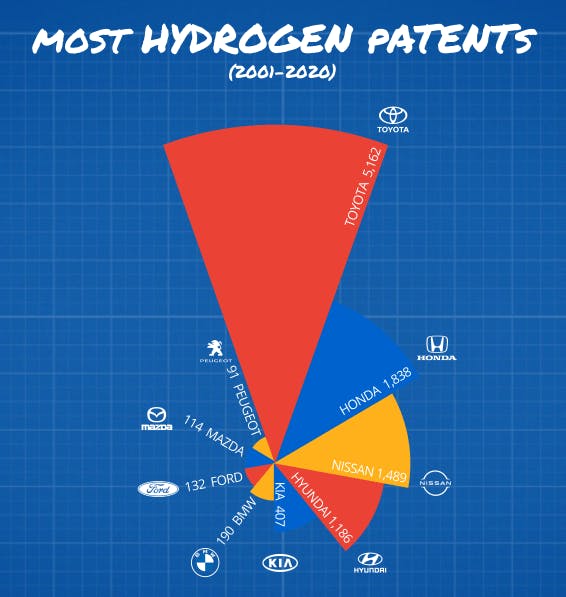

Leading manufacturers investing in hydrogen technology

In January 2020 the Hydrogen Council, an organisation comprising 92 major companies, claimed that the 2020s will be “the decade of hydrogen”.

It’s been a bit of a bumpy start to the decade so we’ll forgive the car manufacturers for not making a whole lot of noisy headway.

Looking at patent applications, however, a few of the big car manufacturers have been filing a whole bunch of patents on the matter and continue to do so.

The top three is entirely made up of East Asian manufacturers with Toyota taking the hot spot with 5,162 patents, followed by Honda with 1,838 and in third place with 1,489 patents — Nissan.

Whether it’s something that will take the world by storm in this decade, we’ll have to wait and see.

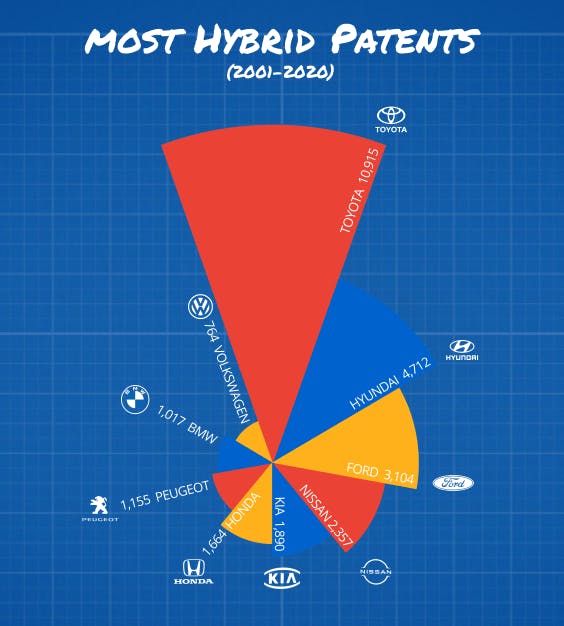

Leading manufacturers investing in hybrid technology

The hybrid market is pretty comprehensive at the moment and ever-expanding. Whilst some argue that hybrids should not be considered green, there’s no denying that the vast majority of hybrids are greener compared to their diesel and petrol counterparts.

It’s no big surprise that Toyota (10,915 hybrid patents) is the number one holder of hybrid patents amongst our 25 car manufacturers. Pushing out models like the Yaris, Auris and the Prius, Toyota has really entered and conquered that market.

Second place is Hyundai (4,712 hybrid patents), also no big surprise there. Over the past 10 years, Hyundai has put an increasing emphasis on greener alternatives and are currently taking the fully electric market by storm too.

Ford has grabbed a third-place (3,104 hybrid patents) which in Europe at least is a bit of a surprise. There are neither a lot of hybrid or electric Fords kicking about the United Kingdom, and especially not if you go back a few years. Perhaps they’re preparing for a hybrid revolution?

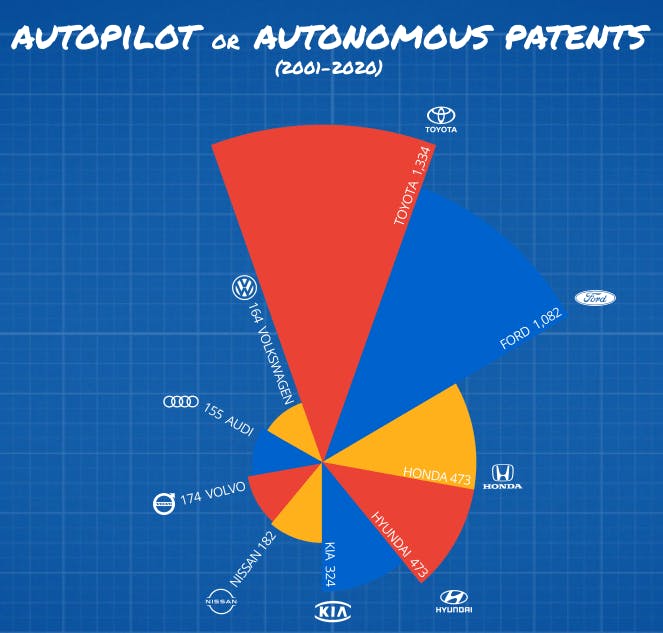

Leading manufacturers investing in autonomous technology

On Monday 22 of February, Toyota held a ground-breaking ceremony commencing the work on their smart city at the foot of Mount Fuji. The city will act as a "living laboratory" where they will test autonomous tech, robotics and artificial intelligence. A project of this scale infers that Toyota means serious business when it comes to new and emerging tech, including autonomous technology. These grand plans are also indicative of why Toyota grabs another first place as the leading patent holder for autonomous tech with 1,334 parents.

On a close second place is Ford with 1,082 autonomous and autopilot patents over the past 20 years.

Third place goes to Honda with 473 autonomous or autopilot patents.

Summary

When it comes to automotive innovation, there is a crystal clear pattern emerging from patent data: East Asian manufacturers lead the way.

Grabbing 4 of the top 5 most innovative car manufacturer spots, as well as top spots for electric, hydrogen, and hybrid technology innovation, these manufacturers have pulled miles ahead of the rest of the world.

Whilst US Ford nabbed a few top spots, other US and European manufacturers haven’t been quite so successful - will they ever catch up?

And what else have these leading innovative manufacturers got in store for us in the next 20 years?

Methodology

- Using the patent database Espacenet, we reviewed all car manufacturers and picked the 25 with the most patent applications.

- We ran a script to grab all patent data per manufacturer over the past 20 years (2000-2020) from Espacenet.

- Using Google Sheets we combined the exported patent data and the Cooperative Patent Classification (CPC) index allowing us to assign values/ themes to the CPC codes.

- We analysed the data through a custom script and then in Google Sheets